Quarterly Newsletter - Q1 2025

January 1, 2025

2024 Year in Review

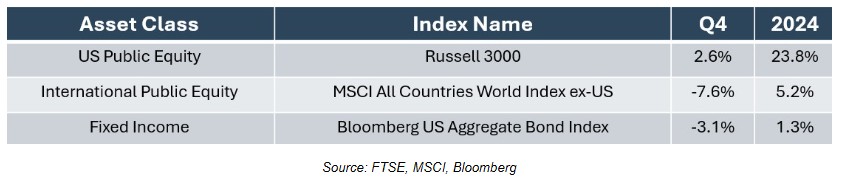

As we look back on 2024, there were a handful of themes that impacted markets. First was the continued dominance of US stocks over their international counterparts (more on this below). The Russell 3000 index of US stocks gained nearly 24% for the year while the MSCI All-Countries ex-US index gained just over 5%. This was the second consecutive year of 20%+ returns for US stocks, something that hasn’t happened since 1997-98.

The next big trend was interest rates and the Federal Reserve. Coming into 2024 (as in 2023), expectations were that the Fed would begin to cut rates and that the bond market would return to ‘normal’. As the first rate cut announcement approached in mid-September, the rate on the 10-year US Treasury bond was around 3.9%, down almost 1% from the 2024 high of 4.8%. However, as the Fed continued to cut rates two more times before the end of the year, the rate on the 10-year reversed course and finished the year back at 4.8%.

Lastly, the uncertainty around the US election was finally put to rest in November and various asset classes rallied in response. The Russell 3000 index of US stocks rose almost 7.5% to new all-time highs in the wake of the election. The dollar climbed almost 6%, Bitcoin soared more than 50%, and even the Bloomberg Aggregate Bond Index saw a brief 2% rally before rates began to climb again.Our Thoughts on the Markets

2024 Election and Legislative Outlook

Key Takeaways:

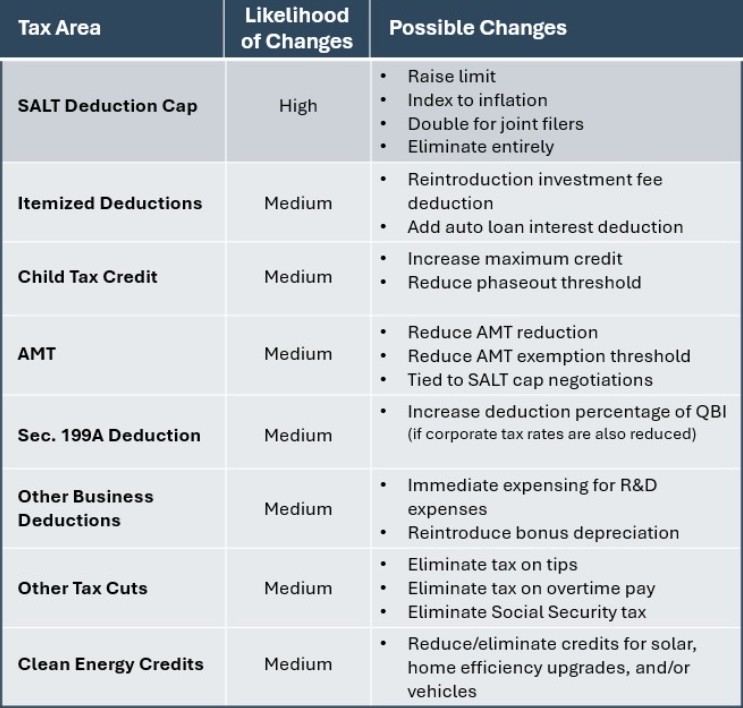

- As the second Trump administration prepares to take office, what campaign promises might become law?

- The Tax Cuts and Jobs Act (TCJA), currently set to expire at the end of 2025, is front and center.

- The estate tax exemption is a top concern for many, but changes to the Alternative Minimum Tax, State and Local Tax deduction cap, and Qualified Business Income deductions could have an impact on many more taxpayers.

US Stocks Outperform International

Key Takeaways:

- US stocks now make up approximately 50% of the global equity market compared to about 30% in the aftermath of the Great Financial Crisis.

- Much of this can be attributed to the higher proportion of the US stock market that is composed of ‘growth’ companies.

- Inevitably, even the best relative trades fade, but only time will tell when international stocks begin to catch back up to US stocks.

Source articles: US Economic, Market Dominance in 4 Charts & What Does a Once-in-a-Generation Investment Opportunity Look Like?

Schechter Insights

Wealth and Wellness: Balancing Wealth Accumulation with Personal Fulfillment - For ultra-high-net-worth individuals, the pursuit of wealth often demands relentless focus, innovation, and sacrifice. But once financial goals are achieved, another challenge arises: How do you find fulfillment beyond accumulating assets? Balancing the pursuit of wealth with personal wellness and a sense of purpose is a delicate act. Read more

Transferring Wealth to the Next Generation: Essential Tips for Wealthy Families - Transferring wealth to the next generation is about more than dollars and cents; it’s about ensuring your family’s values, legacy, and goals endure for generations to come. Read more

How to Sell Your Business: A Step-by-Step Guide - Selling a business is a significant decision with lasting impacts, both financially and emotionally. Whether you're considering retirement, looking to pursue new ventures, or simply ready to pass the reins, understanding the process can help you achieve your goals and maximize the value of your hard work. Read more

Schechter in the News

Newsweek | America’s Top Financial Advisory Firms 2025 - Newsweek has named Schechter one of America’s Top Financial Advisory Firms for 2025. This recognition highlights the dedication, expertise, and client-first approach that have been the foundation of our work for decades. Read more

Detroit Free Press | 2024 Michigan Top Workplace - Schechter has been awarded a coveted spot on the list of Michigan's Top Workplaces for 2024. This recognition highlights Schechter's ongoing commitment to fostering a positive, employee-focused culture, setting it apart as one of the state's best employers. Read more

Forbes | Top RIA Firms in the Country 2024 - Schechter Investment Advisors is proud to be included on the Forbes/Shook Top Registered Investment Advisors (RIAs) for 2024. Out of over 46,000 nominations, only 250 firms were selected to be included on this prestigious list. Read more

Financial Advisor Magazine Interviewed Marc Schechter and Aaron Hodari, CFP®, CIMA® About Schechter's Rapid Growth - Schechter Investment Advisors has tripled its business in the last five years, in part by introducing its high-net-worth clients to alternative investments, according to the firm’s leaders. Read more

Disclosure

While information presented is believed to be factual and up-to-date, Schechter does not guarantee its accuracy, and it should be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. Investments market value is exposed to many factors such as the operational an financial conditions of the relevant company growth prospects, change in interest rates, the economic and political environments, foreign exchange rates, shifts i market sentiments. etc. Therefor, no representation is made, or assurance given that such views are correct and such views may have become unreliable for various reasons, including changes in market conditions or economic circumstances. Such views have been formed based upon information that was available at the time of this newsletter. Nothing in this newsletter should be interpreted to state or imply that past results are an indication of futured performance. Schechter and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for information purposes only, and is not intended to provide, and should be relied on for, tax, legal or accounting advice. You should consult you won tax, legal and accounting advisors before engaging in any transaction. Past performance does not guarantee future results. Inherent in any investment is the potential for loss as well as the potential for gain.