SOFR Interest Rate Update - May

May 7, 2024

On May 1st, the US Federal Reserve (The Fed) kicked off the new month with near-universally expected news: they held US Federal Funds Rates (Fed Rates) steady for a sixth consecutive meeting and openly acknowledged the lack of progress toward their 2% inflation objective. In both The Fed’s press release and Fed Chair Jerome Powell’s post-meeting press conference, they reiterated their commitment to the “wait and see” approach they’ve been taking since the last rate hike in July 2023, noting they “[do] not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.”1 Powell also noted that the Fed “will carefully assess incoming data, the evolving outlook, and the balance of risks” while considering what to do with Fed Rates going forward.2

While many analysts have begun to worry that rate hikes could be back on the table following this year’s higher-than-anticipated inflation data, Powell stated that wasn’t currently on their radar. He shared they’d need more convincing evidence that higher rates are necessary to bring down inflation before hikes would be considered again.3 While Powell left the door open for future rate hikes, he suggested the more likely outcome was a longer period of holding rates steady, barring any progress on inflation or an economic slowdown.3

Following The Fed meeting, markets have adjusted and we updated our borrowing rate assumptions to reflect the current outlook. Below are charts and additional analysis showing forward rate projections and key items of interest to monitor between now and our next update.

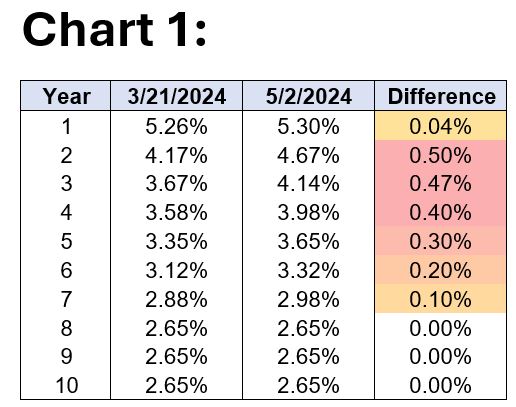

Chart 1 below compares our current Secure Overnight Financing Rate (SOFR) projections to our March 21st projections. These rates are based on the most-current Fed Dot Plot and the SOFR Forward Curves on each date shown. Short and mid-term projections continue to rise throughout 2024, up by an average of 29bps over the next 7 years, as compared to March 21st. Our long-term projections remain unchanged, as they are derived from The Fed’s Dot Plot chart, which is updated following their final meeting of each quarter.

Y1-7 Average Difference: 0.29% | Y1-10 Average Difference: 0.20%

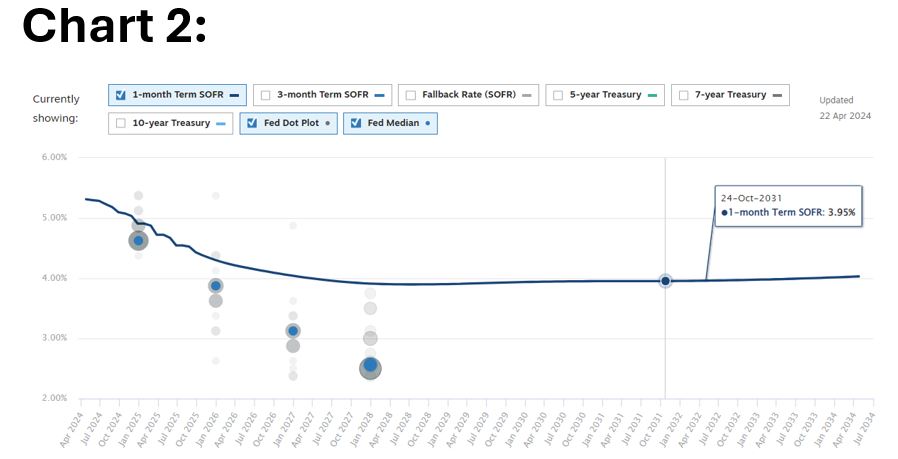

The most-recent Dot Plot (gray dots) is shown on Chart 2, along with the Dot Plot median (blue dots) and current SOFR forward projections from Chatham Financial (blue line). While our last update showed markets predicting more rapid rate cuts than The Fed projected, the opposite is now true. Looking at the end of 2025, the Dot Plot Median is approximately 50bps lower than the current market projections. Barring any changes in inflation or wage growth, we expect this gap to hold until the Fed’s updated Dot Plot chart is released following their June meeting.

This data fluctuates daily, and what is depicted above is as of 5/2/2024.

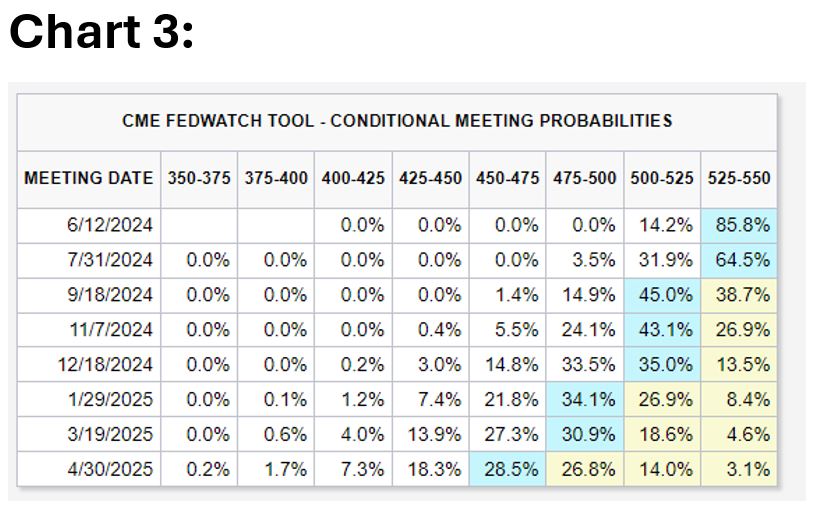

Many analysts are currently hedging their bets regarding rate cuts in 2024, which you can see in Chart 3. This shows CME Group is currently projecting 68.5% odds of either one or two rate cuts this year, down considerably from our March 21st update, when they were projecting 76.8% odds of at least three rate increases in 2024. This reflects the challenges both The Fed and investors are facing, which Powell summed up very well in his post-meeting press conference, stating, “Inflation has eased notably over the past year but remains above our longer-run goal of 2 percent… The inflation data received so far this year have been higher than expected.”2

This data fluctuates daily, and what is depicted above is as of 5/2/2024.

While Powell remains optimistic inflation and economic activity are generally moving in the right direction, four consecutive months of worse-than-expected data on price and wage pressures have caused many investors to take a more pessimistic view.4 For the time being, The Fed’s message and outlook remain as they have for the past several months: while they remain confident future rate hikes are unlikely, they’re content to hold rates steady and will not rush to make cuts until they have “greater confidence that inflation is moving sustainably toward 2 percent.”2

Following their meeting, The Fed also announced they will reduce the amount of securities holdings maturing each month from $60 billion to $25 billion.1 While this isn’t expected to have any immediate impact on interest rates, it is a proactive measure of quantitative easing (QE) and signals that The Fed believes increasing the liquidity in the financial system may help provide stability and avoid unnecessary market disruptions.5

The Fed’s continued “wait and see” strategy, combined with the stagnant inflation and economic data, increases the odds that Fed Rates could hold steady throughout most, if not all, of 2024. However, that could change quickly if the economy starts to show signs of slowing down. Historic trends tell us that rate hikes and cuts happen more quickly than forward projections predict and the rate hike cycle of the last two years was particularly fast.6 While there’s no guarantee the same will be true for any upcoming rate cuts, The Fed’s current stance of waiting and reacting suggests that proactive, gradual rate changes are less likely than quicker and more reactive changes going forward.

Ultimately, we anticipate one of four scenarios playing out and forcing The Fed’s hand on interest rates (listed below). Until then, investors should be prepared for rates to sit where they are for the foreseeable future.

- The economy starts to show signs of slowing, forcing The Fed to cut rates to avoid crushing the economy under the pressure of higher rates.

- Inflation begins to trend back downward, allowing The Fed to start cutting rates proactively to avoid undue economic stress.

- Inflation begins increasing again at a more rapid pace, forcing The Fed to renew rate hikes.

- Inflation remains above 2% for an extended period of time and the economy shows no signs of slowing, which could eventually force the Fed to raise rates again. While unlikely to occur any time soon, The Fed has consistently made clear their commitment to get inflation down to their 2% target, with Powell stating “of course we’re not satisfied with 3% inflation… 3% can’t be in a sentence with satisfied” in his post-meeting press conference this week.4

Schechter constantly monitors interest rates and updates our rate projections for our Premium Finance designs a minimum of once per month and following every Fed meeting. We will update additionally as needed based on the markets and various influencing factors. If you have any questions or would like to discuss interest rates or any other ongoing economic developments, please reach out to our team to schedule a call.

Sources:

1 https://www.federalreserve.gov/monetarypolicy/files/monetary20240501a1.pdf

2 https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20240501.pdf

6 https://fred.stlouisfed.org/series/FEDFUNDS